• Get your credit score in shape. The higher your credit score, the more bargaining power you’ll have. Do your own research. You can shop in person, by phone, or online with mortgage lenders. What you don't want to do is just mindlessly go with whatever lender your real estate agent recommends -- even if you like that person -- you still owe it to yourself to compare interest rates and negotiate your best deal.

• Contact a mix of financial institutions. Interest rates fluctuate constantly for a variety of reasons, including the occasional promotion of a particular loan product by a financial institution. For example, some lenders who are eager to generate more purchase loans might offer the best mortgage rates for homebuyers rather than refinancing homeowners, says Brian Martucci, a mortgage lender with GetLoans.com in Washington, D.C. Sometimes a credit union or bank will introduce a new loan product and offer better mortgage rates in order to entice borrowers, says Craig March, a branch manager with Inlanta Mortgage in Janesville, Wisconsin.

"It's best to diversify and try a mix of places such as a direct lender, a regional bank, a credit union, a community bank and a national bank," says March.

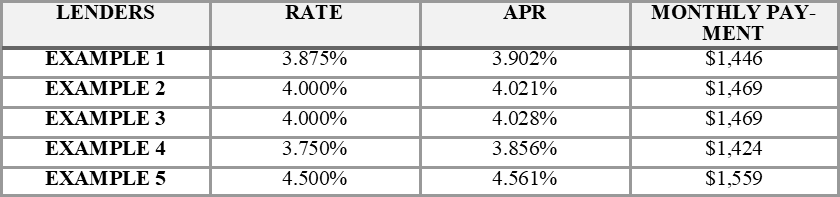

Here’s an example on how even slightly different interest rates may impact your monthly mortgage payments.

• Ask about fees. The various fees associated with a loan are one reason why you shouldn't comparison shop solely based on the best advertised rate. Sometimes an advertised rate can be lower than all the rest because of all the fees associated with it. "Some lenders blend all their fees into a loan preparation fee, while others separate them out, so be sure to ask for the total amount it will cost to close the loan," says Martucci. Generally, a mortgage with higher fees should have a lower interest rate, says March.

• Always provide the same information. Make sure when you request a rate quote that you provide all lenders with the same information:

• The quality of your credit

• The location, type, and use of your property

• Size of your down payment or the amount of home equity you have

Keep in mind that mortgage rates change often, so quotes obtained today can't be reliably compared against quotes given tomorrow.

• Call lenders on the same day. Mortgage rates fluctuate constantly, so you should call lenders as close to the same time as possible on the same day to compare the best mortgage rates, says Martucci.

"If possible, call within the same timeframe, because a bond rally could mean that mortgage rates have dropped dramatically from the morning to the afternoon," he says.

• Interview lenders and decide. Contact the mortgage lenders and notice who gets back to you right away. Pay attention to who asks you questions about your situation, and who answers your questions in an understandable and meaningful way. See who you feel most comfortable with when discussing your financial concerns. At this point, you already know their mortgage rates are competitive, so trust your gut and go with the person you feel best about.

Sources: HSH.com; Nerdwallet.com; Forbes.com; Consumer.ftc.gov; Creditkarma.com

Photo credit: Copyright respective to creator/designer via keyworddream.net